The landscape of digital payments continues to evolve rapidly, with peer-to-peer (P2P) payment apps becoming an integral part of everyday financial transactions. As we step into 2025, the demand for seamless, secure, and instant money transfer solutions is higher than ever. Zelle, one of the leading P2P payment platforms in the U.S., has set a benchmark with its ease of use, rapid transfers, and broad banking network integration.

If you are considering diving into this booming market, developing a P2P payment app like Zelle could be a lucrative and impactful business move. In this guide, we’ll explore everything you need to know about P2P payment app development, from understanding the market and key features to choosing the right technology stack and marketing strategies.

What is P2P Payment App Development?

P2P payment app development refers to the process of creating a digital platform that enables users to transfer money directly to one another without intermediaries such as banks or cash. These apps allow users to send, receive, and request money conveniently using smartphones or computers. Unlike traditional bank transfers, P2P payments are often instant or near-instant, making them ideal for splitting bills, paying rent, or sending gifts.

Building a P2P payment app involves multiple stages, including user interface design, backend development, security implementation, and compliance with financial regulations. The goal is to deliver a reliable, user-friendly, and secure experience that rivals established players like Zelle.

P2P Payment App Market Size & Growth Projections

The global peer-to-peer payment market has witnessed explosive growth over the past decade. As per recent reports, the global P2P payment market was valued at approximately $3.63 trillion in 2025, and projections estimate it will reach over $16.21 trillion by 2034, registering a compound annual growth rate (CAGR) of 18.10% between 2025 and 2034.

Several factors contribute to this surge:

- Increasing smartphone penetration worldwide

- Consumer preference for cashless transactions

- Advances in mobile internet infrastructure (5G rollout)

- Growing trust in digital payment systems due to enhanced security protocols

- Expansion of banking services and digital wallets into emerging markets

By 2025, the P2P payment ecosystem will be more competitive and sophisticated, with users expecting faster, cheaper, and more integrated payment solutions. Therefore, building a P2P payment app like Zelle can position your business well in a high-growth market.

Why Build a P2P Payment App Like Zelle in 2025?

Zelle’s success demonstrates the tremendous demand for fast, reliable, and bank-integrated P2P payment solutions. Here are key reasons why developing a similar app in 2025 makes strategic sense:

- Consumer Demand for Instant Payments: The modern user wants to send money instantly without delays caused by traditional bank transfers. Zelle’s instant settlement model has become the gold standard.

- Integration with Banks: Unlike standalone apps, Zelle partners with numerous banks, enabling users to transact within their banking apps seamlessly. Replicating this model in 2025 will drive adoption.

- Cost Efficiency: P2P payment apps reduce transaction fees compared to credit cards or wire transfers, attracting both consumers and businesses.

- Expanding Use Cases: Beyond person-to-person transfers, P2P apps are increasingly used for small business payments, bill splitting, charity donations, and more.

- Growing Mobile User Base: The global smartphone user base will surpass 4 billion by 2025, providing a huge potential audience.

- Emerging Markets: Many regions are just beginning to embrace digital payments, presenting fresh opportunities to capture market share with a tailored P2P app.

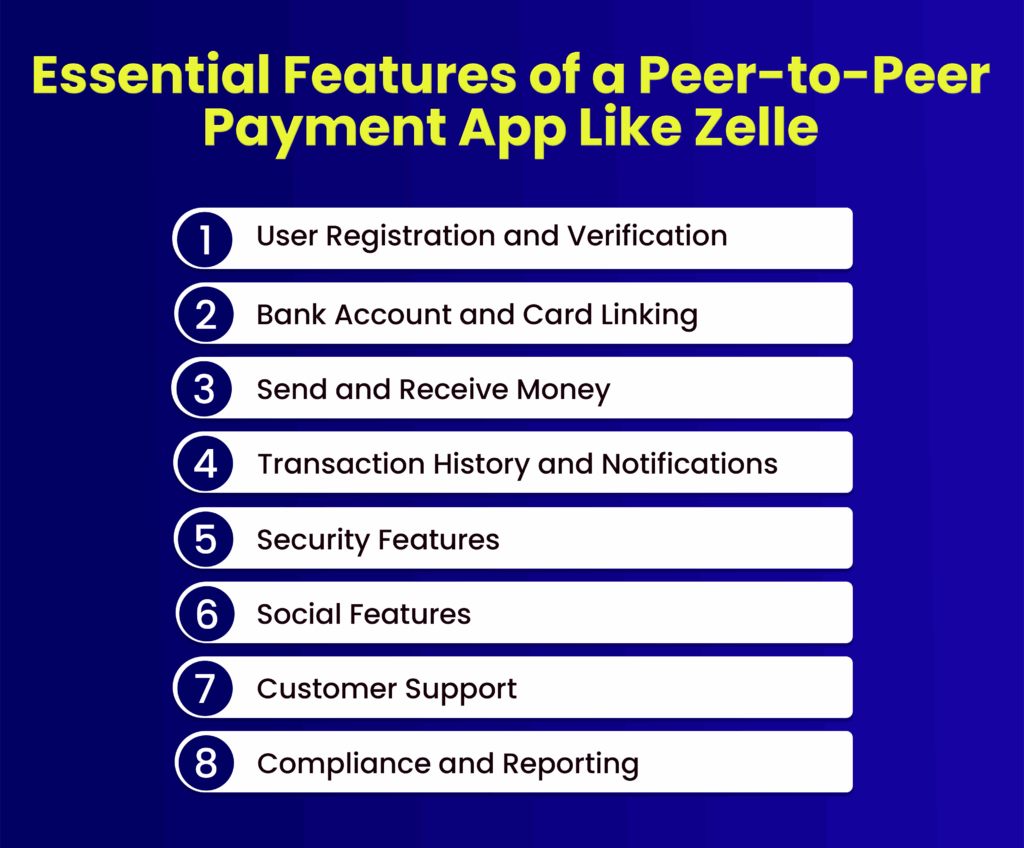

Key Features of a P2P Payment App Like Zelle

To compete with giants like Zelle, your app must offer a robust set of features that enhance user experience, security, and functionality. Here are the essential features:

User Registration and Verification

Allows users to sign up quickly using email or phone, followed by secure identity verification through KYC and multi-factor authentication to ensure compliance and protect against fraud.

Bank Account and Card Linking

Enables users to securely connect multiple bank accounts or debit cards, allowing seamless transfers and real-time balance checks, enhancing usability and trust in the payment system.

Send and Receive Money

Provides instant money transfers using recipient’s phone number or email, with options to request payments, cancel transfers, and schedule future transactions for maximum flexibility and control.

Transaction History and Notifications

Displays a detailed list of all user transactions and sends real-time push notifications or SMS alerts for every payment activity, ensuring transparency and timely updates.

Security Features

Implements biometric login, encryption, and real-time fraud detection to safeguard user data and transactions, ensuring high-level security and compliance with industry standards like PCI DSS.

Social Features

Syncs with phone contacts for quick access to friends, adds payment notes or emojis, and offers a personalized experience that encourages user engagement and social sharing.

Customer Support

Offers in-app live chat, email, and help center with FAQs to quickly resolve user issues, ensuring reliable and responsive support for smooth user experiences.

Compliance and Reporting

Integrates tools to automate KYC, AML, GDPR, and tax reporting requirements, ensuring the app adheres to legal regulations and financial industry standards worldwide.

Technology Stack to Build a P2P Payment App in 2025

Choosing the right technology stack is critical for scalability, security, and performance. Here’s a recommended stack:

Frontend

- Frameworks: React Native or Flutter for cross-platform mobile app development

- Languages: JavaScript/TypeScript or Dart

- UI/UX Libraries: Material UI, Tailwind CSS

Backend

- Languages: Node.js, Python (Django/Flask), or Java (Spring Boot)

- Database: PostgreSQL or MongoDB for structured and unstructured data

- Real-time Messaging: WebSocket or Firebase Cloud Messaging for notifications

- Payment Gateways: Integration with ACH, SWIFT, or Open Banking APIs

- Cloud Services: AWS, Google Cloud, or Azure for hosting, storage, and scaling

Security

- Encryption: TLS/SSL for data in transit, AES-256 for data at rest

- Authentication: OAuth 2.0, JWT tokens, biometric SDKs

- Fraud Prevention: Machine learning models and anomaly detection tools

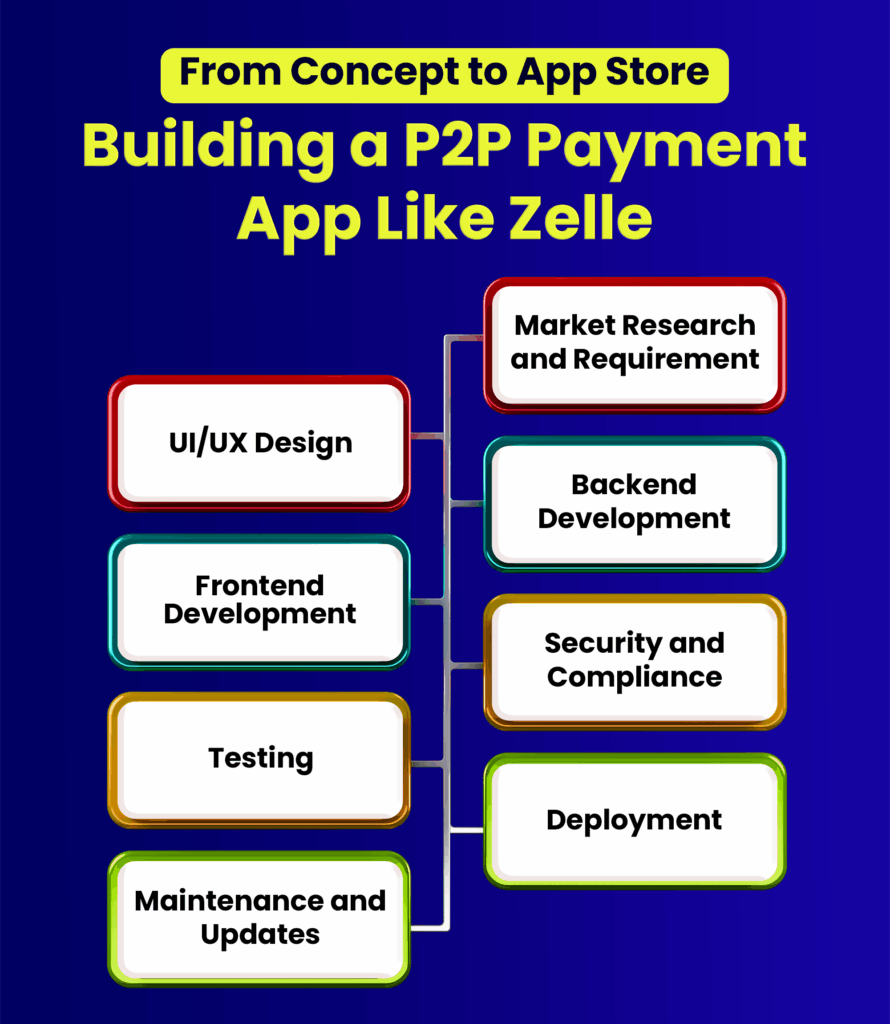

Step-by-Step Process to Build a P2P Payment App Like Zelle

Developing a P2P payment app like Zelle requires a structured approach:

Market Research and Requirement Analysis

Understand your target audience, market trends, and competitors. Define the app’s core value proposition, identify required features, and determine legal and regulatory requirements for launching a secure, compliant P2P payment solution.

UI/UX Design

Create intuitive and user-friendly wireframes and prototypes focused on seamless navigation. Design should ensure minimal friction during transactions while incorporating branding, accessibility, and ease-of-use principles for a superior user experience.

Backend Development

Build a scalable backend architecture with APIs for authentication, payment processing, and notifications. Integrate payment gateways and banking APIs to support real-time money transfers, data management, and secure communications.

Frontend Development

Develop a responsive mobile interface using cross-platform technologies. Focus on clean, fast-loading screens for sending/receiving money, managing profiles, and viewing transaction history, all while ensuring real-time updates and interactivity.

Security and Compliance Implementation

Implement end-to-end encryption, biometric authentication, fraud detection, and compliance with KYC, AML, PCI DSS, and GDPR. These elements are critical to ensure user data protection and regulatory approval.

Testing

Conduct rigorous testing, including functional, performance, security, and usability tests. Identify and fix bugs early, simulate real-world usage scenarios, and verify system stability to ensure a smooth, error-free user experience.

Deployment

Deploy the app to app stores and production servers. Ensure cloud infrastructure supports scalability and high availability. Monitor the launch closely for real-time feedback, immediate bug fixes, and performance optimization.

Maintenance and Updates

Continuously monitor app performance, security, and user feedback. Release regular updates to add new features, address issues, and comply with evolving financial regulations and security standards for long-term success.

P2P Payment App Development Cost

The cost to build a P2P payment app like Zelle can vary significantly based on complexity, features, and region of the development team. On average:

- Basic MVP: $50,000 to $100,000

- Feature-rich App: $150,000 to $300,000+

- Ongoing Maintenance: 15-20% of development cost annually

Factors affecting cost include:

- Number of platforms (iOS, Android, Web)

- Security and compliance requirements

- Integration with multiple banks/payment gateways

- Custom UI/UX design

- Backend infrastructure and scalability needs

Outsourcing to experienced fintech developers or agencies specializing in P2P payment app development can optimize costs and reduce time-to-market.

How to Market Your P2P Payment App Like Zelle?

Marketing a P2P payment app requires a multi-channel strategy focused on trust, ease of use, and utility:

Leverage Bank Partnerships

- Collaborate with banks to pre-install your app or integrate within their digital offerings

- Co-market to existing bank customers

Social Media and Influencer Campaigns

- Use platforms like Instagram, TikTok, and Twitter to raise awareness

- Partner with influencers for authentic endorsements

Referral Programs

- Incentivize users to invite friends with cashback or rewards

- Viral referral loops can accelerate user acquisition

Content Marketing

- Publish blogs, videos, and tutorials educating users about your app’s benefits and security

- Use SEO to drive organic traffic for keywords related to P2P payment app development and digital payments

Paid Advertising

- Use targeted ads on Google Ads and social media platforms

- Focus on demographics with high digital payment adoption

Customer Support Excellence

- Provide 24/7 responsive support to build trust and retain users

- Gather reviews and testimonials to boost credibility

Final Thoughts

Building a P2P payment app like Zelle in 2025 offers an exciting opportunity to tap into the expanding digital payments ecosystem. Success hinges on a well-planned development process that prioritizes security, compliance, and a seamless user experience. Coupled with effective marketing and strategic partnerships, your P2P payment app can capture a significant share of the growing market.

As consumer expectations rise, innovation will be key — integrating AI-based fraud detection, expanding payment options (e.g., crypto), or adding social payment features can differentiate your app from the competition.

Whether you’re a startup, fintech entrepreneur, or enterprise looking to innovate, investing in P2P payment app development now can yield substantial returns and establish your footprint in the future of money transfers.

Useful Resource: eWallet App Development Guide

What do you think?

It is nice to know your opinion. Leave a comment.