India’s Goods and Services Tax (GST) regime, introduced in 2017, was aimed at unifying a complex indirect tax structure into a coherent “one-nation, one-tax” architecture. Yet over time, its multi-tier slab system—5%, 12%, 18%, 28%, plus cess—became a byword for classification disputes and consumer confusion.

Fast forward to mid-2025: Prime Minister Narendra Modi unveiled a sweeping “next-generation” GST reforms—GST 2.0—promising radical simplification. The plan: trim the GST structure to just two main slabs—5% and 18%—while carving out a high-rate 40% band for luxury and sin items. The reform officially received approval at the 56th GST Council meeting and is set to take effect on 22 September 2025, aligning with the festive onset of Navratri.

The intent is clear: empower consumers with relief, fuel festive demand, and streamline compliance—all while positioning India’s indirect tax system for long-term efficiency and growth.

Why Reform Was Needed?

India’s original GST structure—comprising multiple slabs of 0%, 5%, 12%, 18%, 28%, along with special cess—was intended to balance equity and progressivity. But over time, this complex system revealed its flaws: frequent classification disputes, burdensome compliance, and confusion among both businesses and consumers.

The impact on MSMEs was especially acute. Many faced inverted duty structures—higher input taxes than outputs—and sluggish input-tax credit refunds, straining working capital and hampering competitiveness. As a result, the call for simplification gained momentum, with stakeholders urging the elimination of middle slabs, particularly the underperforming 12% bracket, which generated minimal revenue but frequent disputes.

On 15 August 2025, Prime Minister Modi unveiled “GST 2.0” as a festive Diwali promise—aimed at easing household expenses and enhancing economic efficiency. The subsequent GST Council approval of a two-slab system—5% and 18%, plus a 40% rate for sin-and-luxury goods—reflected a policy shift toward greater simplicity, fairness, and economic stimulation.

Crucially, the reform aligns with broader goals: driving consumption demand—especially in festive seasons—boosting compliance, and countering economic headwinds like global tariff pressures.

Anatomy of GST 2.0

Overview of Slab Simplification

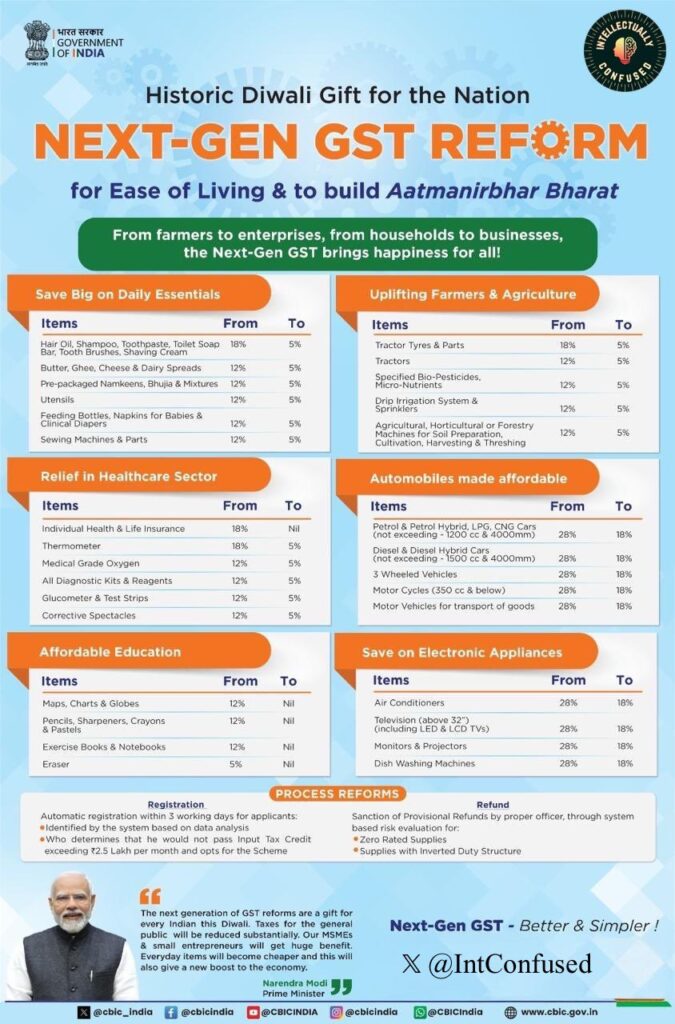

Replaces the four-tier GST structure (5%, 12%, 18%, 28%) with two core slabs—5% for essentials and 18% for most goods. Nearly all items in the former 12% bracket move to 5%, and around 90% from the 28% bracket shift to 18%.

Introduction of a High-Duty Band

A new 40% slab is enforced for “sin and luxury goods” like tobacco, cigarettes, high-end vehicles, and carbonated drinks.

Essentials and Healthcare Benefits

- Everyday staples—such as milk, paneer, roti, noodles, chocolates, toothpaste—are taxed at 5% or even 0%, reducing everyday expenses.

- About 30 cancer medications, key life-saving drugs, and medical-grade oxygen may become entirely tax-free, shifting from 12% to 5%.

Impact on Consumer Durables & Mobility

Major appliances (e.g., ACs, refrigerators), small cars, cement, washing machines, and TVs, previously taxed at ~28%, now attract 18%, enhancing affordability.

Sectoral Relief

Budget hotels offering stays under ₹7,500 and associated restaurant services now fall under 5%, while high-end lodging remains at 18%; sin goods in these services shift to 40%.

Fiscal & Economic Significance

Estimated revenue loss ranges from ₹48,000 crore to ₹93,000 crore (approx. $5.5 billion), while the reform is expected to curb inflation by up to 1.1 percentage point, especially ahead of festive demand.

Simplification & Clarity Gains

The streamlined two-tier structure, supplemented by a targeted high-rate category, significantly reduces classification disputes and eases compliance.

Timeline: From Plan to Rollout

- August 15, 2025: Independence Day marked the formal launch of the “GST 2.0” reform agenda.

- Late August: Group of Ministers (GoM) greenlit the simplified two-slab structure, while voicing state revenue concerns.

- Early September: The GST Council signed off formally on the new structure; rollout slated for 22 September 2025 to align with Navratri.

This tight timeline underlines the reform’s political and economic urgency.

What’s Cheaper—and What’s Not

What’s Cheaper

- Essentials & Daily Goods

Items like packaged food, milk products, toothpaste, and medicines now face just 5% GST, down from 12–18%, offering clear relief on routine purchases. Insurance products are also now exempt.

- Consumer Durables & Electronics

TVs, mobile phones, ACs, washing machines, dishwashers, and refrigerators see reduced GST to 18%, from the previous 28%, making these big-ticket items more affordable.

- Automobiles & Related Goods

Taxes on cars, especially while big-car effective rates were trimmed to 40% (from 50%), and special cars like EVs remain at 5%, giving a major push to auto demand.

- Cement & Construction Supplies

Cement and related construction materials now attract 18% GST, down from higher brackets—boosting affordability just before the festive-buying season.

What’s Not (or More Expensive)

- Apparel Over ₹2,500

Clothes and accessories priced above ₹2,500 are now taxed at 18%, up from 12%, affecting premium apparel segments and brands like Levi’s and Zara.

- Sin and Luxury Goods

Tobacco, pan masala, fizzy drinks, and luxury items remain lofty at 40% GST, preserving high-taxed status for these non-essential categories.

- Coal

GST on coal has risen to 18%, increasing the cost for industries reliant on coal.

Quick Summary

| Segment | GST Now | Previous Rate | Direction |

| Essentials & insurance | 5% | 12–18% or exempt | Cheaper |

| Electronics, autos (incl. EVs) | 5–18% | 28–50% | Much cheaper |

| Apparel (₹2,500+) | 18% | 12% | More expensive |

| Sin/luxury goods | 40% | 28% | Still costly |

| Coal | 18% | Lower | More costly |

This revamped structure simplifies GST while strategically easing costs ahead of Diwali, especially across essential and aspirational purchase categories—though certain luxury, apparel, and sin goods are set to carry forward the burden.

Notable Reactions from Industry & Leaders

Narendra Modi (Prime Minister of India)

During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST.

— Narendra Modi (@narendramodi) September 3, 2025

The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and…

Amit Shah (Home Minister of India)

PM Shri @narendramodi Ji stands for what he commits.

— Amit Shah (@AmitShah) September 3, 2025

This historic decision of GST rate cuts and process reforms will bring huge relief to the poor and middle class, while also supporting farmers, MSMEs, women and youth.

By simplifying the system and reducing the burden on… pic.twitter.com/yYVUCOtCvG

S. Jaishankar (External Affairs Minister of India)

Delivering on PM @narendramodi’s Independence Day announcement, the @GST_Council decision to adopt the #NextGenGST today will have huge impact on the transformation story underway in India and the Government’s effort to improve ease of living & doing business.

— Dr. S. Jaishankar (@DrSJaishankar) September 3, 2025

Congratulate PM…

Anish Shah (CEO & MD, Mahindra Group)

#NextGenGST reforms mark a defining moment, simplifying compliance, easing costs on essentials, correcting inverted duties & energising key sectors like auto, agri, healthcare, renewables & MSMEs. A bold step aligned with the Hon’ble PM’s vision of a citizen-centric, future-ready… https://t.co/V1PfroVu2v

— Anish Shah (@anishshah21) September 3, 2025

Harsh Goenka (Industrialist)

Big Diwali gift 🎁 for every Indian!

— Harsh Goenka (@hvgoenka) September 3, 2025

GST on daily essentials, healthcare, education & farming inputs slashed.

🛒 Cheaper groceries

💊 Relief in healthcare

📚 Affordable education

🚜 Support for farmers

Next-gen GST = ease of living + boost to economy.

Amitabh Kant (Former NITI Aayog CEO)

A landmark reform. The reduction of GST rates to just 5% and 18% is a bold and visionary step. Simplifying the structure, rationalising rates and eliminating inverted duties will boost consumption, raise capacity utilisation, and drive fresh investment. This, in turn, will fuel…

— Amitabh Kant (@amitabhk87) September 3, 2025

Projected Revenue & Economic Impact

The reform comes with fiscal trade-offs and projected gains:

- Revenue Loss: Estimated between ₹48,000–₹93,000 crore (~$5.5 billion), though on the lower side of initial forecasts.

- Consumption Boost: By incentivizing durables and essentials, especially during the festive season, the reform is expected to stimulate consumer spending and economic momentum.

- Inflation Relief: Analysts anticipate a reduction of ~1.1 percentage point in inflation—significant for household budgets.

- Sector Gains: FMCG companies (HUL, Nestlé, Godrej), auto (Maruti, Toyota), appliances (LG, Sony), and hospitality sectors are poised to gain from improved affordability and demand.

Consumer Benefits: What’s in Your Basket

Everyday Essentials at Lower Costs

Goods like milk, paneer, roti, biscuits, noodles, toothpaste, soaps, and essential medicines now fall under the 5% GST slab, giving households immediate relief at the checkout. Items like health and life insurance are now exempt, further easing financial pressure.

Groceries and Daily Staples Become More Affordable

Products previously in the 12% bracket—such as packaged food, frozen vegetables, ghee, butter, and cooking oils—are now being shifted to the 5% rate, reducing grocery bills significantly.

Durables and Home Appliances Become Diet-Friendly

TVs, air conditioners, refrigerators, and mobile phones now attract GST at 18%, down from 28%, helping families upgrade appliances without breaking the bank.

Automobile and Construction Sector Benefits

GST on small cars, two-wheelers, cement, and auto parts has been reduced, encouraging purchases during the festival season and improving affordability of essentials like housing supplies and vehicles.

Overall Boost to Consumer Sentiment and Spending

Market and industry leaders foresee a rise in consumption, particularly among the middle class. Gains are expected even in rural areas, as the dual benefit of lower prices and simpler tax structure delivers tangible relief.

Key Advantages of GST Reforms for Middle-Class Households

Cheaper Daily Essentials

Items like milk, paneer, roti, toothpaste, soaps, and ready-to-eat snacks now fall under the 5% GST slab or are fully exempt. This move directly reduces the regular grocery and personal care expenses for families.

Lower Household Grocery Bills

Essentials such as dairy, ghee, butter, sauces, and packaged biscuits now attract lower GST—aligning with the middle class’ weekly and monthly purchase patterns.

Affordable Durables & Appliances

Tax on items like air conditioners, TVs, refrigerators, and washing machines has been reduced from 28% to 18%, making these high-demand goods more accessible to middle-class families looking to upgrade their homes.

Reduced Auto and Transport Costs

Small cars, bikes (up to 350cc), cement, and auto parts now attract lowered GST—spurring savings when purchasing vehicles or undertaking home improvements.

Relief on Insurance and Health Costs

Life and health insurance policies are now exempt from GST, resulting in significant savings—for example, health cover premiums around ₹50,000 could save families approximately ₹7,000–8,000 annually. Additionally, over 30 specialized medicines (including cancer drugs) now attract zero GST.

Big Impact on Household Budgets

As a whole, these reforms are expected to boost disposable income and promote higher consumption, particularly critical during the festive season when sustained spending stimulates festive cheer and market activity.

Summary Table

| Category | Reform Impact |

| Essentials & FMCG | Lower GST leads to savings on daily basics |

| Consumer Appliances | Cheaper ACs, TVs, fridges boost affording capacity |

| Auto & Construction Goods | Reduced transport and building costs |

| Insurance & Health | GST exemption makes coverage more accessible |

| Overall Household Budget | Increased disposable income and stronger consumer sentiment |

These reforms genuinely empower middle-class families, making essential items and aspirational purchases more affordable, fostering stronger budgets and uplifting consumption potential. The timing, just ahead of Navratri and Diwali, further amplifies the impact.

Winners & Losers: Industry, States, Consumers

Winner

- Consumers and Households

Everyday essentials—from milk, packaged foods, toothpaste, to medicines—have shifted to a 5% GST slab or become entirely tax-exempt. This provides immediate relief for households grappling with inflation.

- Industry Sectors

Consumer goods giants like Hindustan Unilever, Nestlé, and Godrej stand to benefit from boosted demand for affordable products. Appliance and auto manufacturers—such as Maruti, Toyota, LG, and Sony—are expected to see surging festive sales as big-ticket items become cheaper. Electric vehicles remain incentivized with a 5% tax rate.

- Financial Markets

Stock markets reacted positively, with consumer and auto sectors experiencing gains. Analysts foresee a potential 100–120 bps GDP boost over the next year due to increased consumption.

Losers / Concerned Actors

- Apparel Brands over ₹2,500

Tax for premium clothing has jumped from 12% to 18%, potentially denting demand for brands such as Marks & Spencer, Levi’s, and Zara.

- States (Revenue Impact)

States are raising alarm over potential revenue losses. Jharkhand is seeking ₹2,000 crore annually in compensation, while Punjab demands ₹60,000 crore to offset shortfalls. Opposition-led states have proposed relying on proceeds from luxury sin-goods levies or extended compensation mechanisms.

- Central vs State Balance

Revenue rationalization may strain fiscal federalism. Though SBI reassured states they will remain net gainers this year, the post-cess transition period brings uncertainty.

Structural & Compliance Reforms

Simplified Slabs & Classification Clarity

GST 2.0 narrows the tax structure to two core slabs—5% and 18%—plus a 40% levy on sin and luxury goods, streamlining what had been a complex multi-tiered system and reducing classification disputes.

Digital Transformation & Faster Refunds

Investments in digital infrastructure—like e-invoicing mandates, real-time SMS-based Invoice Management Systems (IMS), and a public compliance-rating framework—are enhancing transparency and speeding up refunds. These measures underpin trust and encourage better compliance.

Bolstered Legal Framework & Appealing Mechanisms

The move to simplify slabs is complemented by legal streamlining—amnesty schemes to resolve old disputes, and operationalization of the GST Appellate Tribunal (GSTAT) to provide quicker, fairer dispute resolution.

Criticisms & Challenges Ahead

Transition Burden for Businesses

The shift requires businesses to overhaul pricing, re-label inventory, and update software systems. MSMEs especially may struggle with training and operational disruptions during the transition.

Enforcement of Anti-Profiteering Measures

Ensuring that businesses pass tax savings to consumers is critical. Without strong monitoring and clarity, there’s a risk of inadequate benefit transfer, which could reduce public confidence.

State Revenue Concerns & Federal Balance

States have signaled concern over revenue shortfalls. While arrangements like higher GST revenue shares—up to 70% of collections—are proposed to cushion states, uncertainty remains about long-term fiscal impact.

Digital & Infrastructure Demands

The GSTN portal and infrastructure must scale adequately to handle revamped returns and ITC processes, or else technical glitches could hamper compliance—especially for smaller enterprises.

Looking Ahead: GST 2.0’s Legacy

GST 2.0 is envisioned as much more than a rate change—it’s a structural leap towards a simplified indirect tax system:

Laying the Path for a Single-Rate GST

While retaining two slabs, experts anticipate GST 2.0 as a strategic move toward a unified single-rate VAT structure in future reforms for greater clarity and audit efficiency.

Boosting Economic Momentum

By putting more money back in pockets, encouraging investment, and easing regulatory burdens, GST 2.0 could elevate GDP growth by 100–120 basis points in the next 4–6 quarters.

Formalization & Trust in Tax Institutions

The digital and legal upgrades make compliance accessible, boosting trust among taxpayers and bringing more of the informal economy under the formal tax net.

Conclusion: More Than a Diwali Gift

GST 2.0 isn’t just festive relief—it’s structural transformation. This reform simplifies the slabs, broadens compliance accessibility, and sets the stage for systemic ease and inclusivity.

- For households, cheaper essentials mean immediate savings at the grocery counter.

- For MSMEs and businesses, clarified rates and faster refunds reduce friction and open growth pathways.

- For the states, the move prompts fiscal recalibration, but with careful planning, it promises improved efficiency.

- For the nation, it’s a broader promise: inclusive growth, digital integration, and a GST regime that aligns with global standards.

As GST 2.0 rolls out from 22 September 2025, its success hinges on execution. If the government ensures enforcement, builds digital capacity, and navigates state-centered concerns, GST 2.0 could mark the most pivotal evolution in India’s tax architecture yet—bridging reform with resilience.

What do you think?

It is nice to know your opinion. Leave a comment.