Businesses that want to get money for their new coin projects use an Initial Coin Offering (ICO). It means giving early backers of the project some cryptocurrency in return for cash or other cryptocurrencies, most often Ethereum or Bitcoin. This way, startups can get funds faster because they don’t have to go through the strict and controlled process that venture investors and banks do.

Initial Public Offerings (IPOs), in which buyers buy company shares, are like the idea behind ICOs. But people who take part in an ICO don’t get shares. Instead, they get tokens, which sometimes represent a stake in the project itself or access to the service the project plans to build. The worth of these tokens may rise, especially if the project is a hit and many people use it.

ICOs are a unique way to get into the blockchain and crypto space. They come with their own set of risks and possibilities. They make business chances more open to everyone, so almost anyone can take part in early-stage ideas that could be profitable. But the world of ICOs is also full of risks, such as scams and legal confusion, since the market is still growing.

Rise of ICO in the Crypto Market

Initial Coin Offerings (ICOs) are becoming more popular in cryptocurrency. This is a big change in how projects get money and buyers interact with new technologies. Since it started to take off around the middle of the 2010s, this trend has changed how people trade in the blockchain and bitcoin sectors. At first, initial coin offerings (ICOs) were a new, uncontrolled way for projects to connect directly with possible investors worldwide, skipping standard financial intermediaries.

ICOs are appealing because they make business possibilities more open to everyone. Traditional venture capital investments are usually only available to a small group of qualified buyers. On the other hand, initial Coin Offerings (ICOs) let more people participate in early-stage funding. Because of this open method, investors have put in more money than ever before. At their peak in 2017 and 2018, ICOs earned billions of dollars.

The lightning-fast growth of blockchain technology and rising interest in cryptocurrencies made ICOs so popular so quickly. Entrepreneurs and developers saw ICOs as a flexible and quick way to raise the money needed to continue working on their new projects. On the other hand, investors were drawn to the crypto market because they thought it would allow them to make a lot of money.

| Related Blog…👇 Blockchain App Development Guide |

But this fast growth came with problems, like increased attention from regulators as governments and financial authorities looked into what the laws said about initial coin offerings (ICOs). Even with these problems, there is no doubt that the rise of initial coin offerings (ICOs) has been a major factor in raising money for the growth of the blockchain ecosystem. These ICOs have helped a wide range of projects, from digital currencies to decentralized applications (dApps), and have also helped the cryptocurrency market become more mature.

How To Build an ICO App?

When making an ICO app, it’s important to pay attention to security, compliance, and user experience. This method has several steps to ensure that the app not only meets the technology needs for releasing tokens but also follows all applicable laws. Here is a short guide:

Plan and Write a White Paper

Have a clear picture of the job in your mind before you start. The technology, the problem it solves, tokenomics, and the rules of the ICO should all be in your white paper.

Ensure you follow the law

hire lawyers to help you navigate the complicated regulatory environment. To escape legal problems, it is essential to follow stock rules.

Build the coin and Smart Contracts

Pick a blockchain platform and build your coin on it. Smart contracts will run the ICO automatically, safely handing out tokens and collecting funds.

Strong security measures must be implemented

security cannot be compromised. Rigid security rules and smart contract checks can help you keep your app safe from threats.

Launch and Market Your ICO

Focus on making a site that users will enjoy for your ICO. A well-thought-out marketing plan will help you get backers and build a group around your project.

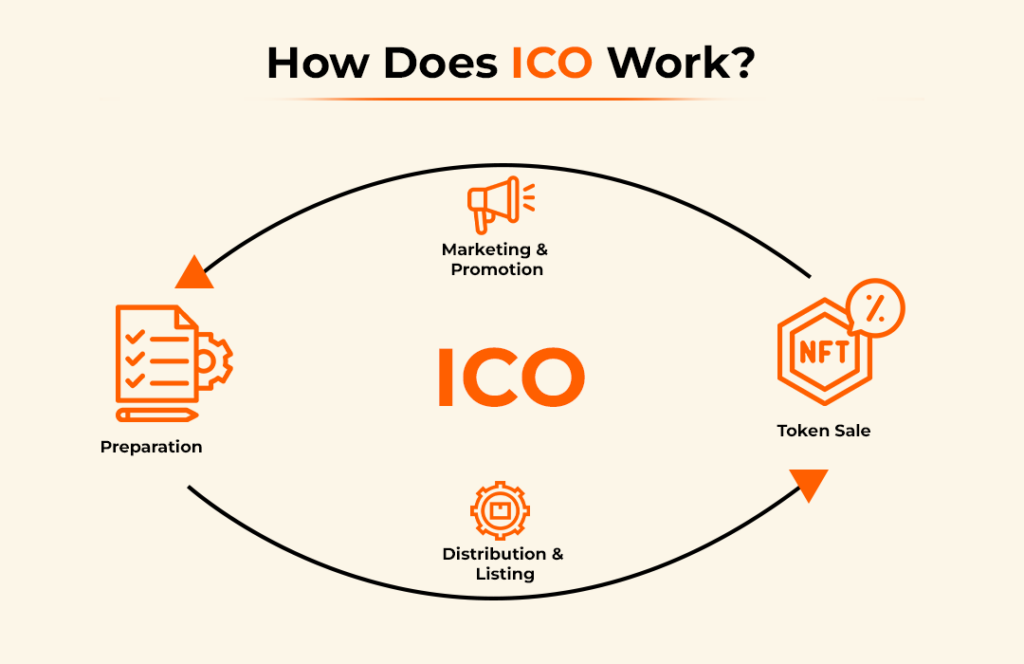

How Does ICO Work?

To raise money, an Initial Coin Offering (ICO) lets a new cryptocurrency project sell some of its cryptocurrency pieces to early users and cryptocurrency fans in return for cash. This step is usually taken before the project is fully started. It allows buyers to buy tokens cheaper, hoping the value will increase once the project fully runs. Here’s a quick rundown of how the ICO works:

Preparation

The project team writes a white paper that describes the project in detail, including the technology, tokenomics, and the road map. They also set the terms of the ICO, such as the price and number of tokens.

Marketing and Promotion

The team starts marketing to get people interested in the idea and become investors.

Token Sale

When the ICO occurs, buyers buy the project’s coins with existing cryptocurrencies like Bitcoin or Ethereum, or sometimes with regular money.

Distribution and Listing

Tokens are sent to buyers’ wallets after the ICO. The project team wants the coin to be listed on cryptocurrency markets so that it can be bought and sold.

Benefits of ICO Development

The growth of initial coin offerings (ICOs) is good for businesses, investors, and the blockchain and cryptocurrency industry as a whole. Take a look at all of the benefits below:

For Startups:

Access to Capital

Initial Coin Offerings (ICOs) are a quick and easy way to get money from people worldwide. This contrasts traditional funding methods that can take a long time and have strict rules.

Market Validation

Startups can find out early on if their idea has a market potential by seeing how interested possible funders are in it.

Building a Community

Initial Coin Offerings (ICOs) help raise money for a project and unite users and fans. This gives early backers a sense of ownership and loyalty.

Speed and Efficiency

Starting an ICO can be faster and more efficient than traditional stock fundraisers. This means that money can be put toward project growth more quickly.

For Investors:

Early Access to Possible Gains

Investors can buy tokens early on, which could mean big profits if the project works.

Making investing more accessible

Initial Coin Offerings (ICOs) lower the entry barrier for investment possibilities, letting more people participate in startup funding.

Liquidity

Buyers of tokens during an ICO can often sell them on platforms, which is only sometimes possible with traditional startup funding.

Blockchain-Based

ICOs are based on blockchain technology, which provides a high level of openness. This lets buyers see how their money is being spent and how the project is progressing.

For the Ecosystem:

Growth and New Technologies

Initial Coin Offerings (ICOs) help the blockchain industry grow by funding the creation of new technologies and apps.

Regulatory Changes

The popularity of initial coin offerings (ICOs) has led lawmakers worldwide to create and change legal rules, which has helped the cryptocurrency market mature.

Cost to Build ICO

How much it costs for ICO development depends on many things, such as how complicated the project is, which blockchain platform is used, how much legal work needs to be done, and how much marketing is done. There are several important parts to a full ICO creation process, and they all add to the total cost:

Developing ideas and writing a white paper

It’s important to write a complete paper and business plan. You will study the market, plan the project, and make records during this time. The price can be anywhere from a few thousand dollars to tens of thousands, based on how much study and help is needed.

Legal Compliance and Advice

For an ICO, knowing how to deal with the law is important. Legal costs for ensuring that regulations in chosen countries are followed can vary a lot and often go up to tens of thousands of dollars.

Technical Development

A big chunk of the costs go toward making the coin, smart contracts, and the ICO site itself. Depending on its hardness, this can cost anywhere from $5,000 to over $100,000. Smart contracts must also be inspected for security reasons, adding to the cost.

Marketing and Community Management

For an ICO to be successful, it’s important to have strong marketing efforts and active communities. Depending on how big and far the marketing goes, budgets can be anywhere from $20,000 to over $100,000.

Extra Costs

Holding events, running reward programs, and paying advisors are some other costs that can add to the total cost.

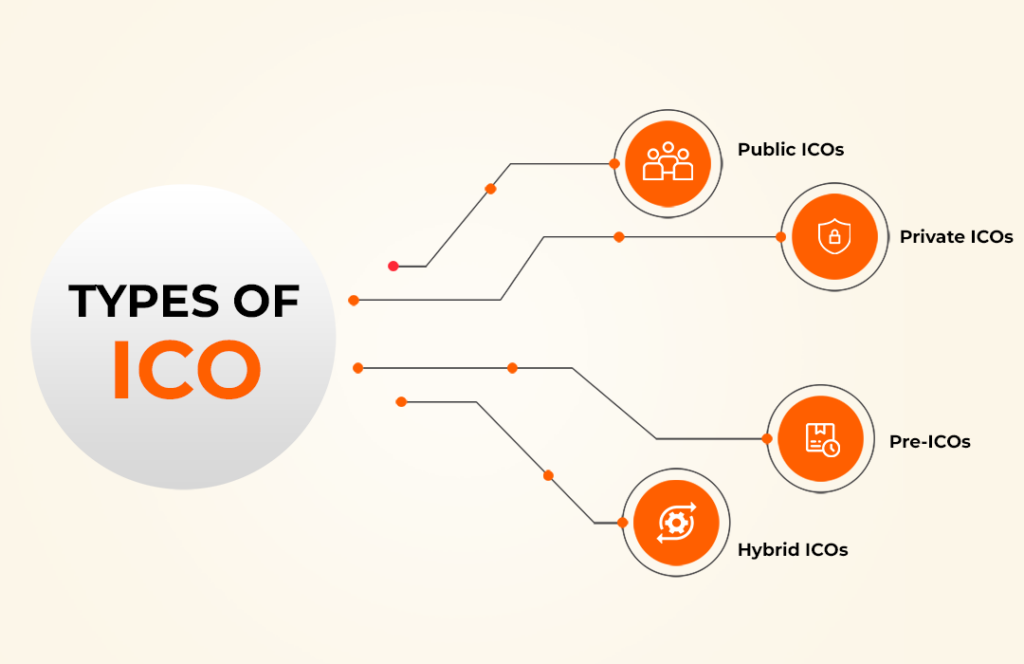

Types Of ICO

Initial Coin Offerings (ICOs) have changed over time to fit the needs of companies and different legal environments. Both producers and buyers need to know about the different kinds of ICOs. These are the main kinds:

1. Public ICOs

Description: The most common form, open to the general public, allows anyone to invest. Public ICOs have been the traditional way to raise funds from various investors worldwide.

Characteristics: High exposure and potential for significant fundraising, but with increased regulatory scrutiny.

2. Private ICOs

Description: Private ICOs target a select group of investors, usually institutional or accredited investors, rather than the general public.

Characteristics: Lower regulatory hurdles and often larger investment minimums. This type can offer more security to the project and the investors but limits participation to a smaller, vetted group.

3. Pre-ICOs (or Pre-sales)

Description: A pre-sale phase before the main ICO, offering tokens at a lower price to early investors. This stage aims to raise initial funds to cover the expenses of launching the main ICO.

Characteristics: Limited-time offers, often with a cap on the amount raised, provide early investors with lower prices.

4. Hybrid ICOs

Description: Combines elements of public and private ICOs, offering stages or tiers where initial rounds may be private or limited to certain investors before opening to the public.

Characteristics: Flexibility in fundraising, allowing projects to secure initial capital from private investors while expanding access to a broader audience.

How ICO’s Making Revenue?

When companies and projects in the blockchain and cryptocurrency fields use initial coin offerings (ICOs), they mostly do so to raise money. But the question of how ICOs make money goes beyond the money they raise initially. Let’s take a better look:

Direct Capital Injection

First-Time Fundraising: The most direct way for projects to make money through ICOs is to sell tokens to buyers. This money is for the project’s growth, marketing, and ICO development.

Secondary Revenue Streams

Token Appreciation: Projects can keep some of the tokens they get from the ICO. If the project works and the token’s value rises in the coin markets, the value of the kept tokens can bring in a lot of money.

Ecosystem Growth

Transaction Fees for Ecosystem Growth: Transaction fees can be a steady source of income for projects that build platforms or services. The fees can keep the project going as the site gets more famous and people use it.

Service and Product Offerings

Premium Features and Services: For a fee, projects can offer extra services, features, or goods that can be accessed through the tokens for that project. This makes people want the tokens, which can raise their value and help both the project and those who own them.

Network Effects

Strategic Partnerships and Collaborations: ICOs that do well often get other companies and projects to join them. These partnerships can create new ways to make money by working together on projects or making the project’s environment and coin more useful.

What do you think?

It is nice to know your opinion. Leave a comment.