In today’s fast-paced world, financial emergencies can arise anytime, and waiting days for loan approvals is no longer practical. This is where instant personal loan apps in India have completely changed the game. With just a smartphone and a few basic documents, you can now get quick personal loan approval in minutes—no lengthy paperwork, no endless bank visits.

Whether you need funds for medical expenses, education, home renovation, or even a wedding, these personal loan apps in India offer fast disbursals, competitive interest rates, and flexible repayment options. Backed by RBI-registered NBFCs and financial institutions, they ensure secure digital lending with complete transparency.

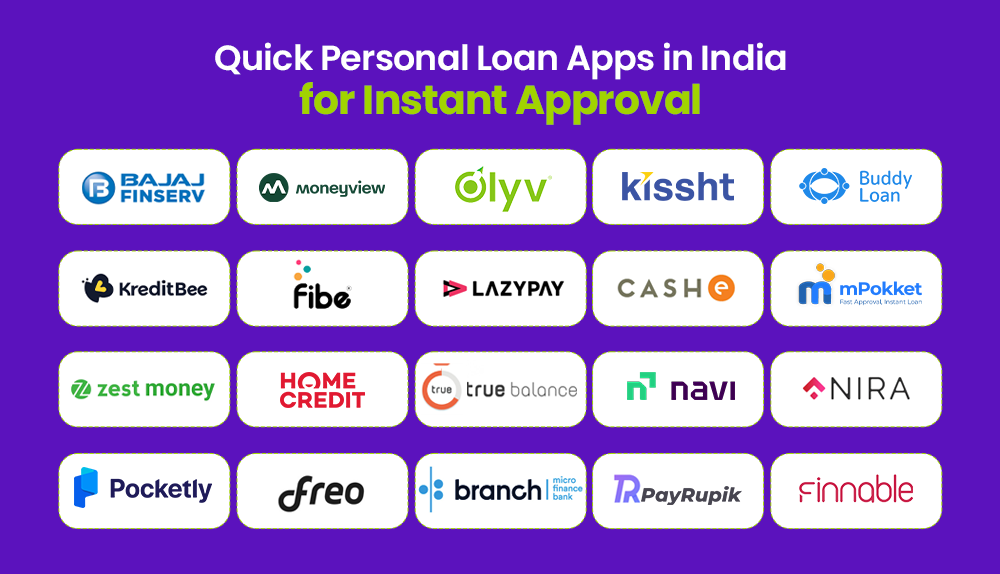

In this blog, we bring you the top 20 instant personal loan apps in India for 2025, helping you compare features, interest rates, and eligibility so you can pick the best personal loan app for your needs.

The Rise of Instant Personal Loan Apps in India

Over the last few years, instant personal loan apps in India have transformed the way people access credit. Earlier, getting a personal loan meant visiting banks, submitting piles of paperwork, and waiting several days for approval. Today, thanks to digital lending platforms, the process has become completely online, quick, and hassle-free.

These personal loan apps in India leverage cutting-edge technologies like AI, machine learning, and big data analytics to evaluate creditworthiness within minutes. With features like paperless loan applications, e-KYC verification, and real-time approvals, borrowers can now get quick personal loan approval from the comfort of their homes.

Moreover, RBI-registered NBFCs and financial institutions back most of these apps, ensuring safe and secure lending practices. The growing popularity of fast disbursal personal loan apps also caters to the rising demand among salaried individuals, students, and small business owners who need instant access to credit without complicated processes.

Key Features to Look for in a Personal Loan App

When choosing the best personal loan apps in India, focus on features that make the borrowing experience seamless, secure, and quick. Below are the essential factors to consider:

Quick Personal Loan Approval

Look for apps that process applications within minutes, offering instant personal loan approval without long waiting periods.

Paperless Loan Application

A good loan app in India should have a 100% digital process with e-KYC and minimal documentation for faster disbursal.

Flexible Loan Amounts

The app should offer loans starting from as low as ₹1,000 up to ₹25 lakhs to cater to both small and large financial needs.

Competitive Interest Rates

Check for apps providing low interest personal loan options with clear breakup of fees and no hidden charges.

Flexible Repayment Tenures

Choose apps offering repayment plans ranging from 3 months to 36 months with customizable EMIs.

Secure and RBI-Registered Platforms

Always select apps backed by RBI-approved NBFCs for safe and transparent lending practices.

User-Friendly Interface

The app should have a simple, intuitive interface for hassle-free loan applications and tracking.

Real-Time Loan Status Updates

Features like live tracking and instant notifications enhance user experience.

Customer Support Availability

Round-the-clock customer assistance ensures smooth query handling throughout the loan journey.

Benefits of Using Instant Loan Apps

Quick Personal Loan Approval

Most instant personal loan apps in India approve applications within minutes, eliminating long waiting periods and providing fast access to funds for urgent needs without unnecessary delays or complications.

Paperless Loan Process

These loan apps in India offer 100% digital documentation through e-KYC, saving time and making the entire application process smooth, convenient, and completely hassle-free for borrowers anywhere across the country.

Flexible Loan Amounts

From small-ticket loans of ₹1,000 to larger amounts exceeding ₹25 lakhs, best personal loan apps cater to diverse financial needs, helping salaried individuals, students, and self-employed professionals alike.

Competitive Interest Rates

Many low interest personal loan apps provide transparent pricing, clear EMI breakdowns, and zero hidden fees, ensuring borrowers understand the repayment schedule and total costs before accepting the loan offer.

Customizable EMI Options

Borrowers can select repayment tenures between 3 to 36 months on most personal loan apps in India, making it easier to manage finances and avoid excessive monthly repayment burdens conveniently.

Safe and Secure Lending

With RBI-registered NBFCs backing these platforms, fast disbursal personal loan apps ensure data security, compliance with regulations, and trusted lending practices, providing borrowers confidence while applying for loans online.

Top 20 Must-try Instant Personal Loan Apps in India

- Bajaj Finserv

- Moneyview

- Olyv

- Kissht

- Buddy Loan

- KreditBee

- Fibe

- LazyPay

- CASHe

- mPokket

- ZestMoney

- Home Credit

- True Balance

- Navi

- Nira

- Pocketly

- Freo

- Branch

- PayRupik

- Finnable

Bajaj Finserv

Bajaj Finserv is one of the best personal loan apps in India, offering instant personal loans up to ₹25 lakhs with flexible repayment tenures and competitive interest rates. With minimal documentation, quick personal loan approval, and same-day disbursal, it’s perfect for salaried professionals and self-employed individuals needing funds for emergencies, education, or home renovation.

Moneyview

Moneyview provides instant personal loans in India ranging from ₹5,000 to ₹5 lakhs with 24-hour disbursal. Featuring paperless applications, real-time credit assessment, and customizable EMI options, it ensures hassle-free borrowing for both salaried and self-employed users, making it one of the most trusted personal loan apps for fast and secure online lending in India.

Olyv

Olyv offers instant loans in India up to ₹1 lakh with a 100% digital application process and quick approval. Known for its easy interface and transparent terms, Olyv is perfect for individuals looking for fast personal loans without tedious paperwork, ensuring financial flexibility during medical emergencies, education expenses, or short-term funding needs with minimal hassle.

Kissht

Kissht is a popular personal loan app in India offering credit for personal needs and e-commerce purchases. With flexible EMIs, instant approval, and minimal documentation, it has become a go-to platform for borrowers seeking fast disbursal personal loans in India, especially for shopping, travel, and lifestyle-related expenses requiring quick financial assistance with transparent repayment options.

Buddy Loan

Buddy Loan acts as a loan aggregator app, connecting borrowers to multiple lenders for instant personal loan approval at competitive rates. With loans ranging from ₹10,000 to ₹15 lakhs, flexible tenures, and secure digital lending, it simplifies the borrowing process, ensuring users find the best instant loan apps in India tailored to their credit requirements quickly and easily.

KreditBee

KreditBee is widely known among instant personal loan apps in India for providing quick credit access to students, salaried employees, and self-employed individuals. Offering loans starting as low as ₹1,000, it features instant approval, minimal paperwork, and flexible repayment options, making it a reliable choice for small-ticket personal loans in India with fast and secure disbursal processes.

Fibe

Fibe, formerly EarlySalary, offers salary advances and instant personal loans with repayment flexibility up to 36 months. Designed for young professionals, it provides quick personal loan approval, minimal documentation, and affordable interest rates. Fibe is ideal for emergencies, lifestyle expenses, and short-term funding, making it one of the best personal loan apps in India for salaried users.

LazyPay

LazyPay is both a credit line app and a platform for instant personal loans in India, offering fast approvals and minimal KYC requirements. With features like one-click loan disbursal, transparent charges, and flexible EMIs, LazyPay ensures borrowers have quick access to credit for bills, shopping, and emergencies without waiting days for traditional loan approvals or complex paperwork.

CASHe

CASHe specializes in instant personal loans for salaried individuals, providing small-ticket credit with same-day approvals and disbursals. Its credit line facilities, quick loan approval process, and flexible repayment options make it perfect for managing mid-month financial crises, lifestyle expenses, and emergency situations without collateral, offering convenience through a completely digital and user-friendly borrowing platform for Indian consumers.

mPokket

mPokket focuses on students and entry-level professionals, offering instant loans in India starting at just ₹500. With fast approvals, minimal documentation, and flexible repayment schedules, it is a preferred choice among young borrowers looking for quick personal loan apps to meet education-related expenses, emergencies, or lifestyle needs without relying on traditional banks and their lengthy loan processes.

ZestMoney

ZestMoney is a BNPL (Buy Now, Pay Later) platform that doubles as an instant personal loan app in India. It offers credit for online/offline purchases with no-cost EMI options, quick approval, and zero paperwork. Popular among shoppers, it enables users to access credit instantly while repaying in easy EMIs, making it a modern alternative to traditional lending solutions.

Home Credit

Home Credit provides personal loans in India up to ₹5 lakhs with minimal documentation and quick digital processing. Known for its transparent interest rates, simple eligibility criteria, and flexible repayment schedules, it caters to individuals seeking fast disbursal personal loans for education, emergencies, or home-related expenses through a secure and user-friendly lending platform accessible via smartphone apps.

True Balance

True Balance offers micro-loans in India with same-day disbursal and a paperless application process. Designed for quick access to small-ticket credit, it serves salaried individuals and self-employed borrowers who need fast personal loan approvals without complex requirements, ensuring convenience, affordability, and transparent repayment plans directly through its digital lending platform with real-time credit assessment capabilities for borrowers.

Navi

Navi is a fully digital instant personal loan app in India offering loans up to ₹20 lakhs with interest rates starting at 9.99% p.a. Known for its quick approvals, minimal documentation, and paperless processing, Navi ensures users can access funds instantly, making it one of the best personal loan apps for salaried and self-employed professionals across India easily.

Nira

Nira provides instant personal loans in India up to ₹1 lakh with same-day approvals and minimal paperwork. Catering primarily to salaried individuals, Nira ensures borrowers can apply online, upload documents, and receive funds instantly, making it a fast personal loan app for emergencies, education expenses, or short-term financial needs with affordable interest rates and flexible repayment schedules.

Pocketly

Pocketly targets students and young professionals by offering instant loans in India starting at ₹500. With fast approvals, simple eligibility criteria, and quick disbursal, it provides small-ticket credit for lifestyle needs, emergencies, and educational expenses, ensuring convenience and affordability. Its paperless loan process makes Pocketly one of the most user-friendly instant personal loan apps for new borrowers.

Freo

Freo is India’s first credit line-based personal loan app, providing instant credit access with flexible repayment options. Designed for salaried professionals, it offers low interest personal loan options, transparent charges, and fast approvals, helping users manage financial requirements easily while ensuring a seamless borrowing experience through its secure and RBI-registered digital lending platform for modern Indian consumers.

Branch

Branch is an international personal loan app offering instant loans in India with real-time approvals and minimal documentation. Known for its global presence and secure lending practices, it provides small to medium-ticket loans quickly, making it a trusted choice for individuals seeking fast disbursal personal loan apps with transparent interest rates and straightforward eligibility requirements for digital borrowing.

PayRupik

PayRupik provides small-ticket instant personal loans for salaried individuals with fast approvals and 100% online processing. It is ideal for borrowers needing emergency funds for medical expenses, lifestyle needs, or short-term requirements. With its quick personal loan approval system and transparent repayment terms, PayRupik has emerged as a reliable loan app in India for immediate financial assistance easily.

Finnable

Finnable offers instant personal loans in India up to ₹10 lakhs with 24-hour disbursal and competitive interest rates. Designed for salaried professionals, it provides quick loan approvals, paperless applications, and flexible repayment options, making it one of the most trusted personal loan apps for individuals seeking secure, fast, and convenient credit access for diverse financial requirements nationwide in India.

Comparison Table: Loan Amounts, Interest Rates & Eligibility

| App Name | Loan Amount Range | Interest Rate (p.a.) | Approval Time | Eligibility |

| Bajaj Finserv | ₹30,000 – ₹25 Lakh | From 11% | 24 hours | Salaried / Self-Employed |

| Moneyview | ₹5,000 – ₹5 Lakh | From 1.33% per month | 24 hours | Salaried / Self-Employed |

| Olyv | ₹10,000 – ₹1 Lakh | Variable | Instant | Salaried Individuals |

| Kissht | ₹5,000 – ₹5 Lakh | From 14% | Within 24 hours | Salaried / Self-Employed |

| Buddy Loan | ₹10,000 – ₹15 Lakh | From 11.99% | 1–2 Days | Salaried / Self-Employed |

| KreditBee | ₹1,000 – ₹2 Lakh | From 1.02% per month | 15–20 min | Salaried / Students |

| Fibe | ₹5,000 – ₹5 Lakh | From 2.5% per month | Instant | Salaried Employees |

| LazyPay | ₹10,000 – ₹1 Lakh | From 18% | Instant | Salaried Individuals |

| CASHe | ₹5,000 – ₹2 Lakh | From 2.5% per month | Same Day | Salaried Individuals |

| mPokket | ₹500 – ₹20,000 | From 3.5% per month | Within 24 hours | Students / Freshers / Salaried |

| ZestMoney | ₹1,000 – ₹2 Lakh | From 18% | Instant | Salaried / Self-Employed |

| Home Credit | ₹10,000 – ₹5 Lakh | From 19% | 24–48 hours | Salaried / Self-Employed |

| True Balance | ₹5,000 – ₹50,000 | From 2.4% per month | Same Day | Salaried / Self-Employed |

| Navi | ₹10,000 – ₹20 Lakh | From 9.99% | Instant | Salaried / Self-Employed |

| Nira | ₹5,000 – ₹1 Lakh | From 1.5% per month | Within 24 hours | Salaried Individuals |

| Pocketly | ₹500 – ₹10,000 | From 3% per month | Instant | Students / Freshers |

| Freo | ₹5,000 – ₹5 Lakh | From 16% | 24–48 hours | Salaried / Self-Employed |

| Branch | ₹1,000 – ₹50,000 | From 2% per month | Instant | Salaried / Self-Employed |

| PayRupik | ₹2,000 – ₹20,000 | From 2.5% per month | 1 Day | Salaried / Self-Employed |

| Finnable | ₹50,000 – ₹10 Lakh | From 12.5% | 24 hours | Salaried / Self-Employed |

How to Choose the Right Instant Loan App?

- Loan Amount Requirement: Match your borrowing needs with the app’s limits.

- Interest Rates: Look for low interest personal loan apps.

- Approval Speed: Some apps approve loans within minutes.

- Eligibility: Check credit score and income criteria.

- Repayment Flexibility: Choose apps offering customizable EMI plans.

Step-by-Step Process to Apply for a Loan

- Download the App from Play Store or App Store.

- Complete KYC using Aadhaar, PAN, and basic details.

- Enter Loan Amount and choose tenure.

- Submit Documents like bank statements or salary slips.

- Receive Approval within minutes or hours.

- Get Funds Disbursed directly to your bank account.

Why Synarion IT Solutions Stands Out as the Best Loan App Development Company?

When it comes to loan app development in India, Synarion IT Solutions has established itself as a trusted and innovative technology partner. With 7+ years of experience in fintech app development, the company specializes in creating instant personal loan apps that are secure, scalable, and user-friendly.

- Expertise in secure, scalable loan app solutions

- Integration of AI-based credit scoring and real-time disbursal engines

- User-friendly interfaces for seamless experiences

- Custom solutions for NBFCs, banks, and fintech startups

- End-to-end development from UI/UX to backend security

With Synarion, you get more than an app—you get a future-ready fintech solution tailored for success.

Final Words

The growing popularity of instant personal loan apps in India has revolutionized the way people access credit. With quick personal loan approvals, paperless processing, and secure digital platforms, these apps have made borrowing easier, faster, and more transparent than ever before. Whether you are a salaried professional, student, or business owner, the best personal loan apps provide flexible loan amounts, customizable EMI options, and competitive interest rates to suit every financial need.

As the demand for fast disbursal personal loan apps continues to rise, businesses looking to enter this market require reliable technology partners. Companies like Synarion IT Solutions stand out for their expertise in loan app development, offering innovative and secure solutions tailored to modern lending requirements. Choosing the right platform ensures a seamless borrowing experience for users and a scalable, profitable venture for businesses.

FAQs

Which is the best personal loan app in India?

Apps like Bajaj Finserv, Moneyview, and Navi are highly trusted for quick approvals and low rates.

Are instant personal loan apps safe?

Yes, if they’re RBI-approved or tied with registered NBFCs.

How fast can I get a loan through these apps?

Many apps offer instant personal loan approval within 15–30 minutes.

What is the minimum loan amount I can get?

Apps like KreditBee or mPokket start from as low as ₹1,000.

Do I need a high credit score for instant loan apps?

A CIBIL score of 650+ improves approval chances, but some apps offer loans even with lower scores.

Can students apply for personal loans?

Yes, apps like mPokket and Pocketly cater to students.

Is there any hidden charge on these apps?

Most apps display all fees upfront, so read terms carefully before applying.

What do you think?

It is nice to know your opinion. Leave a comment.